This Week in History

April 21-27, 1937:

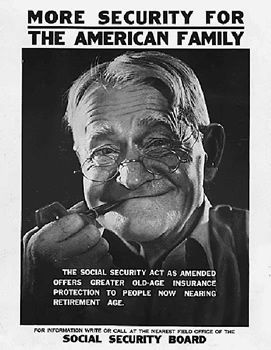

Social Security is Born

April 2013

Franklin Delano Roosevelt.

|

At the end of April 1937, the Federal government of the United States began to send out Social Security checks to Americans 65 years and older. Today, as the representatives of predatory finance threaten to either reduce, or otherwise undercut, this established right of Americans, we do well to recall the origin and significance of what we call Social Security.

The Social Security Act of 1935 was the product of a long struggle within the United States, to implement the concept of the Federal government's powers to tax and act for the "general welfare" of the U.S. population. The Preamble to the bill was just that simple: "An Act to provide for the General Welfare," through providing for old-age assistance, old-age insurance, unemployment insurance, and the like. The bill passed under conditions of intense political struggle, with individuals like Dr. Charles Townsend, a California physician who agitated for public pensions, carrying out a petition campaign for such government aid, which resulted in 20 million signatures, and with the ideologues of Wall Street seeking to spike the plan, eventually with a court challenge which went all the way up to the Supreme Court. It was not until May 24, 1937—after the first checks had begun to be issued—that the Highest Court ruled the Old-Age provision Constitutional under the General Welfare clause.

Conditions for the elderly during the Depression years were particularly horrible. There were approximately 7.6 million people over 65, and only 3% of them were able to get help from the state programs which had been established on their behalf. President Roosevelt had been in favor of providing Federal aid before he entered the Presidency, and when he appointed Frances Perkins his Secretary of Labor, he knew he was putting someone in place who was going to fight for such programs. Perkins testified in her autobiography that FDR was passionate about the need to provide for the poor, old, and destitute, and considered it a "personal affront" that people were subject to such conditions in America.

|

In June of 1934, after having dealt with pressing issues around the banking system, gold, and public works programs, President Roosevelt turned his attention to helping the poor who could not work, or should not be working. He issued a message to Congress which included three subjects: housing, unemployment insurance, and "security against the hazards and vicissitudes of life." Further, the message said that "next winter we may well undertake the great task of furthering the security of the citizen and his family through social insurance." While bending over backwards to be conciliatory to business, Roosevelt said: "We must dedicate ourselves anew to a recovery of the old and sacred possessive rights for which mankind has constantly struggled—homes, livelihood, and individual security. The road to these values is the way of progress."

Immediately after issuing the message, Roosevelt appointed a Cabinet Committee on Economic Security, with Perkins as chairman. The Committee devised the bill which the President introduced into Congress in January 1935, a bill which dealt with social insurance for the aged and unemployed, as well as support for the destitute. Great pains were taken to provide the income for fulfilling the bill's mandates, through taxation on business and individuals, but the principle of a broad entitlement for all of those over 65 was never breached.

It took seven months for FDR's team to get the bill through Congress, by which time its name had been changed to the Social Security Act. Upon the signing on Aug. 14, FDR made the following statement:

"Today, a hope of many years' standing is in large part fulfilled. The civilization of the past hundred years, with its startling industrial changes, has tended more and more to make life insecure. Young people have come to wonder what would be their lot when they came to old age. The man with a job has wondered how long the job would last.

"This social security measure gives at least some protection to thirty millions of our citizens who will reap direct benefits through unemployment compensation, through old-age pensions, and through increased services for the protection of children and the prevention of ill health.

"We can never insure one hundred percent of the population against one hundred percent of the hazards and vicissitudes of life, but we have tried to frame a law which will give some measures of protection to the average citizen and to his family against the loss of a job and against poverty-ridden old age.

"This law, too, represents a cornerstone in a structure which is being built but is by no means complete. It is a structure intended to lessen the force of possible future depressions. It will act as a protection to future Administrations against the necessity of going deeply into debt to furnish relief to the needy. The law will flatten out the peaks and valleys of deflation and of inflation. It is, in short, a law that will take care of human needs and at the same time provide for the United States an economic structure of vastly greater soundness.

"I congratulate all of you ladies and gentlemen, all of you in the Congress, in the executive departments, and all of you who come from private life, and I thank you for your splendid efforts in behalf of this sound, needed and patriotic legislation.

"If the Senate and the House of Representatives in this long and arduous session had done nothing more than pass this Bill, the session would be regarded as historic for all time."

Social Security checks began going out in lump sums to retirees who applied in 1937, and in 1940 began to be paid monthly. It wasn't until 1950 that a cost-of-living allowance was added. Numerous amendments have also expanded the categories of beneficiaries, to include dependents and survivors of those paying into the system, as well as individuals with disabilities. By 1999, the number of beneficiaries per year had risen to 44.6 million. Over 50% of those over 65 years of age depend on Social Security for half or more of their income.

Under these circumstances, as we sink deeper into the new depression, and a total financial blowout looms, the same sharks who opposed Social Security in the first place, are trying to shrink it, or eliminate it. To do so, would be the equivalent of ripping up the Constitutional commitment to the General Welfare.