From "Fake News" to "Fake Economics":

Nobel Prize Committee Rewards a Faker

by Harley Schlanger

October 2017

Harley Schlanger |

October 12 -- In the last year, since the Brexit vote in the U.K. and the election of Donald Trump in the U.S., there has been a growing awareness that the population in the Trans-Atlantic world is being subjected to a dangerous phenomenon known as "Fake News." The distrust of all elites, including those who determine what is covered in newspapers and by the talking heads on television, is part of the dynamic of insurgency which is sweeping the west, and is manifest in the anti-establishment voting patterns, which are overturning "politics-as-usual."

Media censorship and outright lying as a means of social control are not new tactics, as there is a long history of oligarchs using control of media and education to keep people ignorant of the events and processes which shape their lives, making it easier to control them. The British Empire has survived by employing such measures. The ability to sustain authoritarian control over a subject population is the subject of George Orwell's "Nineteen Eighty-Four," published in 1949, in which people at mass rallies were led in chants such as "Ignorance is Strength." One of the maxims of the fictional government imagined by Orwell was "He who controls the past controls the future. He who controls the present controls the past." This is a slogan which describes well the intent behind the proliferation of Fake News today.

How economics experts “count” |

This was the subject of a tract published in 1953 by Bertrand Russell, the evil proponent of the British Empire. Lord Russell wrote, "Education should aim at destroying free will so that pupils thus schooled will be incapable...of thinking or acting otherwise than as their schoolmasters would have wished....It is for a future scientist...to discover exactly how much it costs per head to make children believe that snow is black" (from "The Impact of Science on Society").

One arena of "Fake News" is the coverage in the mainstream media of economic and financial "news." For the propagandists of "neo-liberalism", who dominate the media and the economics profession, stock market and other bubbles represent economic growth; credit for infrastructure investment is axiomatically condemned as "wasteful spending"; free trade enforced by a banker's dictatorship maximizes everyone's freedom; and austerity is the path to prosperity. It is from such precincts that the people are being told that President Obama is responsible for a "robust recovery" from the Crash of 2008, while ignoring the buildup of new bubbles, including levels of debt and leverage which far exceed that which triggered the 2008 crash.

Lord Russell would no doubt be quite pleased that the repetition of such nonsense dominates the field of economics today. For today's respected economists, snow has indeed become black!

What Is "Nudge" Theory

By Matthew W. Hutchins, Harvard Law Record (Own work) [CC BY 3.0], via Wikimedia Commons

Cass Sunstein

|

It is therefore not surprising that this year's Nobel Prize for Economics was given to Richard Thaler, a "behavioral economist" and leading promoter of Sophistical Tomfoolery known as "nudge theory." In 2008, Thaler published "Nudge: Improving Decisions About Health, Wealth and Happiness," which was co-authored by his colleague at the University of Chicago, Cass Sunstein. The University of Chicago's Economics Department was founded as an outpost of British free trade, specifically to organize opposition to the protectionist policies of American System President William McKinley. In announcing the award, the Nobel Committee said Thaler's work "has built a bridge between the economic and psychological analyses of individual decision making," which has provided a "more realistic analysis of how people think and behave when making economic decisions."

Their work was inspired by that of two Israeli behavioral psychologists, Daniel Kahneman and Amos Tversky. Kahneman was awarded the Nobel Economics Prize in 2002. Tversky and Kahneman argued that human beings are not just occasionally irrational, but systemically irrational!

Thaler and Sunstein define a "nudge" as "any aspect of the choice architecture that alters people's behavior in a predictable way without forbidding any options or significantly changing their economic incentives." It is based on the belief that positive reinforcement and indirect suggestions, in the form of a "prompt", can alter behavior, to bring people into compliance with policy goals without the use of force. A "nudge" in the right direction is necessary, they believe, because people are inherently irrational, and allow "gut instincts" to supplant rational choices. After the announcement of his being awarded the Nobel prize, Thaler identified the vote for Brexit as an example of this problem, describing it as an "irrational" action, that is, against the self-interest of residents of the United Kingdom.

Another example of irrationality given by Thaler is that of people who spend for consumption, rather than saving. In Thaler's world, people must be wealthy enough to be able to make a choice, and need only a gentle push to convince them to do so. In reality, according to a study reported on CNN in January 2017, nearly 60% of Americans could not cover an unplanned expense of $500. They do not save NOT due to inherent irrationality, but because they do not earn enough to cover their minimal costs, and must use credit cards to pay for basic expenses, often being forced to choose between buying food, or paying for medical care.

There are now more than seventy-five governments which have established "nudge units" to shift the economic behavior of their citizens. Among the most prominent is the agency set up by former British Prime Minister Cameron, for which Thaler personally served as an adviser. U.S. President Obama brought in Sunstein to administer a "Behavioral Insights Team". One of his tasks was to overcome the resistance of Americans to the insurance swindle and medical triage program known as "Obamacare". Sunstein, who ran the Office of Information and Regulatory Affairs from 2009 to 2012, is described by many who know his relationship with Obama as one of the former President's "controllers," while his wife, Samantha Power, was a leading proponent of regime change wars when she was Obama's Ambassador to the United Nations. It should be noted that such wars, including that which overthrew the Qadaffi government of Libya and that targeting the Assad government, which plunged Syria into a brutal, murderous civil war in which the U.S. was on the side of terrorists, are hardly examples of "nudges" to attain a desired goal.

If the reader is beginning to get the idea that "nudge theory" is more a euphemism for psychological manipulation and social engineering than a scientific concept, then perhaps more forceful nudging is required!

The Underlying Fraud of Nudge Theory

A memo written by EIR economics editor Paul Gallagher on October 10 exposes "nudge theory" as a reaction to the fraudulent theory which preceded it, Efficient Market Hypothesis (EMH), or "rational market theory", which was discredited by the series of bubbles which popped in 1987, from 1998 to 2000, and again with the crash of the housing bubble in 2008. EMH theory argues that the price of a financial asset fully reflects all available information, and is, therefore, based on an entirely rational evaluation. This goes back to Austrian school economist, Friedrich von Hayek, who said markets are the the most effective way of aggregating pieces of information, to determine value. But if EMH were a valid hypothesis, there would never be bubbles!

Thaler argues correctly that bubbles occur when buyers operate on market sentiment, and respond to upticks in stock or other asset valuations, such as mortgage-backed securities, by irrationally rushing in to buy, in order to not miss out on a chance to make money. He describes this as a "herd mentality", when the irrational desire for quick profits prevents investors from looking at the underlying value of what they are buying -- thus the problem, once denied by EMH enthusiast and former Fed Chairman Alan Greenspan, of "irrational exuberance." Greenspan was such a devout adherent to this theory that he described himself in testimony to Congress, after the Crash of 2008, as being "in a state of shocked disbelief", when in reality that crash was the result of his full support of neo-liberal policies, such as repeal of Glass Steagall bank separation, and unregulated trading of financial instruments such as derivatives.

But Thaler's rejection of EMH theory, which was actually discredited by the popping of the bubbles, is hardly rocket science! As Gallagher points out, the fraud of the nudge theory is that it accepts the same underlying axioms as the apostles of EMH, that an economy is about money, about buying and selling, about the valuation of monetary instruments, such as stocks and bonds. The solution to this problem is not having "nudgers," that is, behavioral economists who believe they are rational and therefore superior to the irrational investors, to prompt them to behave rationally, but a return to what American economist Lyndon LaRouche calls the science of "physical economy." LaRouche's unique work in economics begins with the physical science behind economic value, as pioneered by Gottfried Leibniz in the 17th century, and by Alexander Hamilton's invention of the American System in the 18th century.

The driving force of an economy, LaRouche argues, is not pursuit of profit, but the application of human creativity to increase the productivity of labor, funded through a national credit policy. This is how real value is added to an economy. It is through the increase of labor productivity, aided by applications of new technologies and creation of new platforms of infrastructure, that an economy develops.

There is no mention in Thaler's work, of how a real economy works, of how wealth is produced. As LaRouche has said, the awarding of a Nobel Prize in economics is proof of the insanity of the idea being promoted by the awards committee. As Gallagher has quipped, LaRouche's lifelong effort to rescue economics from the blathering of the Fake Economists has earned him a "well-earned freedom from consideration by the ignoble Prize Committee."

Tevye the Dairyman on "Nudge Theory"

by Harley Schlanger

October 2017

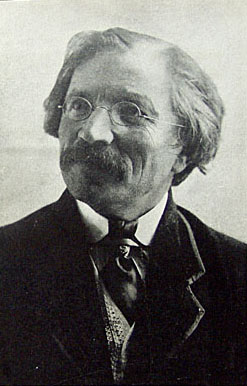

Sholem Aleichem (1859-1916), creator of the Tevye the Dairyman and the Yiddish Renaissance. |

As I sat at my usual table at Kaplan's Deli, for my afternoon coffee, I noticed my old friend Tevye the Dairyman in the corner, hunched over the Kasrilevke Zeitung. From the wrinkles on his brow, I knew that if I went to speak with him, I would soon be facing a torrent of questions, as usual.

But, also as usual, who can resist an opportunity to converse with our neighborhood sage?

"Nu, Tevye?" I asked, as I approached him, "What's on your mind today?"

"Reb Schlanger," he replied, "Have you heard the news from Stockholm? It is most strange. The Alte Kakers [FN 1] there gave an award to a man for being a 'noodge' [FN 2] -- have you ever heard of such a thing?"

Before I could explain to him that the award was not for being a noodge, but for advancing a theory about the economic effects of nudging, he continued: "I wish I would have known about this sooner. If anyone should get an award for being a noodge, it is my dear wife Golde. Oy, such a noodge, she is a real expert. And my daughters, they have learned well from their Mother -- they are such noodges that they can get me to part with my last Kopek.

"Is it too late to apply to this committee of mavens? [FN 3] Maybe we could go collect the money for the prize in Stockholm."

I tried to explain to him that the Nobel Committee only gives awards to people whose work is scientifically verified, and accepted by their peers, but he interrupted me. "My Golde could noodge the bark off a tree. And when she gets going after me, I have no defenses, I do whatever she wants. Isn't that why this Putz [FN 4] won the award, for noodging people to do what he and the other economists think they should do?"

I had to admit, he had a point.

But he wasn't through. "Ach, what do I know? I'm just a poor dairyman, trying to produce some milk and cheese to put bread on my table, and maybe some meat for the Sabbath dinner. Every day, from sun-up to sun-down, I break my back. Do I get any credit for this? Do you think I want to be poor? All that work, and what do I have to show for it -- Bupkes! [FN 5]

"I shouldn't kvetsch [FN 6], at least I have a roof over my head, even though it leaks. As my Golde often tells me, 'Stay healthy, you can always kill yourself later.' But do you think it's easy to get my cows to produce? I tell you, the only thing lazier than them are my chickens, who, God forbid, I should ask them to lay some eggs."

He scratched his head, then broke into one of his big grins.

"You know, maybe I'm a noodge, too. As our wise men wrote in the Talmud, 'It takes a noodge to know a noodge.' Maybe I should apply to that Committee of Schmendricks!" [FN 7]

It is my conviction that there is probably more economic wisdom in Tevye's little toe than in all the big shots who give out such awards. But, who cares what I think, I'm just a poor writer, trying to make some sense out of this Vercockt [FN 8] world."

Footnotes

back to text [1]. Alte Kakers -- Crotchety, fussy old men.

back to text [2]. The word noodge in Yiddish means a pest, a bore, a whiner, strongly implying an annoying quality. One who noodges is often called a "nudnik." It is not clear if Professor Thaler was aware of this when he chose the term to name his theory; however, it is well known that his co-author, Cass Sunstein is fully aware of the term, as his wife, Samantha Power, took being a noodge to a dangerous level, during her time promoting "regime change" as Obama's Ambassador to the United Nations.

back to text [3]. Maven -- A sarcastic word for "experts".

back to text [4]. Putz -- a Fool, or an Ass.

back to text [5]. Bupkes -- a small amount, almost nothing.

back to text [6]. Kvetsch -- to complain.

back to text [7]. Schmendricks -- Jerks, idiots.

back to text [8]. Verkockt -- Implies hopelessly screwed up.