|

||

|

The Essential Role of

‘Time-Reversal’ in Mathematical Economics by Lyndon H. LaRouche, Jr. |

||

|

||

|

‘When’ is the future? At what point in time?...

The answer to this seeming paradox, was already known by Plato, by Augustine of Hippo, and therefore, also, Thomas Aquinas: All time is subsumed under a general regine of simultaneity! |

||

For related articles, scroll down or click here.

The Historical Basis for This Study

To repeat what is already known to those familiar with my work, my original discoveries in economic science, including the material bearing upon “time-reversal,” were prompted by a 1948-1952 project, originally undertaken to refute Professor Norbert Wiener’s radical-positivist hoax of “information theory.” It is relevant, that the success of that 1948-1952 project, was grounded in my intensive study, during my adolescence, of primary sources in Seventeenth- and Eighteenth-century English, French, and German philosophy. That youthful undertaking prompted me to adopt G. Leibniz as my mentor, a dedication which I had affirmed in an essentially competent refutation of those attacks on Leibniz’s work, the which are central to Immanuel Kant’s Critique of Pure Reason.45

Sometimes, as in the present instance, it is as important to know how certain discoveries came about, as to know the details of the discoveries themselves. Human beings, and individual human behavior, do not happen; they are expressions of an historical process. Not to include that process as such, would be to perpetrate a fallacy of composition, by excluding much of that crucially relevant evidence. To assess a person out of his historically determined setting, is such a fraud: a fallacy of composition. The case of my discoveries in that science of physical economy which was founded by Leibniz, is an example of the crucial importance of such an historical approach. The matters immediately to be addressed at this point in the report, are permeated with such specific historical implications as the deeply embedded impression which the Leibniz-Clarke Correspondence, and the posthumously published Leibniz work known as the Monadology, made upon all of my development leading into the 1948-1952 project; one could not understand the discoveries themselves, without considering the functional role of the relevant, historical setting, of the U.S. economy and economic policy, during the late 1940’s and the 1950’s.

As I have stressed repeatedly, in other locations: Knowledge cannot be learned; the student must re-create knowledge, by means of reenacting the type of act of discovery experienced, either as by a relevant original discoverer, or based on the model of a subsequent reenactment of that discovery by some relevant person. The act of discovery is not the communication of a literal statement, but, rather, the student’s solving of a paradox for which no literal solution is available to him. That solution could not be generated within the bandpass of a medium of communication. That re-discovery may be accomplished, only within the sovereign creative mental processes of each individual person. That process, of evoking a successful reenactment of a discovery of principle, within the sovereign bounds of the individual’s cognitive processes, is the only manner in which actual knowledge of a principle could be transmitted.46 That process of rediscovery (not classroom or textbook learning of successful responses to anticipated multiple-choice questionnaires), is knowledge.

My task of presenting the notion of “time-reversal,” to a largely lay audience, albeit one of relatively exceptional literacy and intellectual commitment, is to enable, especially, those readers who are either “Baby Boomers,” or representatives of “Generation X,” to reenact, each in his, or her own sovereign mental processes, the kind of process through which I came to those discoveries represented here. For the reader to accomplish the implied reconstruction, he, or she must be presented with those features of the historically determined background, which brought me into conflict with a specific, relevant nest of paradoxes; he, or she must also be able to reconstruct the historically specific circumstances, the setting in which the challenges motivating the discoveries were experienced. Without at least a strong indication of those features of the setting indicated, the present-day reader would be at a loss to recognize the problem for which those discoveries served as solutions.47

The most important of the preconditions to be met, by any person who came to adulthood after the assassination of President John F. Kennedy, is to muster insight into the historically determined differences between the cultural hypotheses of the “Baby Boomers,” and those of their parents’ and grandparents’ generations. For this purpose, the glib term “generation gap,” excuses more ignorance than it corrects; this involves no mere “generation gap,” but, rather, the moral separation of the “Baby Boomers” from their parents, by a gulf of a “cultural revolution” more fundamental than any experienced since the adoption of our original Federal Constitution. The “Baby Boomer” reader must abandon any sense of “naturalness,” or “self-evident rightness” of today’s “politically correct mainstream-thinking,” and see the fundamental, axiomatic incompatibility between typical American patriots of all earlier generations, and the victims of the 1966-1979 “cultural revolution.”48 The generations are thus separated by axiomatically uncompromisable differences in cultural hypothesis.49 No competent appraisal of the problems of the U.S.A. and the world today were possible, unless the two hypotheses are seen simultaneously, from a higher vantage-point than each.

So, we continue, to complete the remainder of the relevant background.

For all their faults, the first two decades of the post-war U.S. economy were a virtual paradise, if compared to the spiral of degeneration which has dominated policies, practices, and their results, since the 1966-1979 “cultural paradigm-shift.” To understand the mind of the majority of the labor-force from the earlier, relatively happier time, one must take into account the large percentile, much more than a majority, of the total labor-force, the which was engaged either in production and physical distribution of physical goods, in basic economic infrastructure, or scientific and related professions. In that time, we were, predominantly, production-oriented, and the most likely employment opportunity for most, was the nearby factory-gate. As for the small ration among us associated with industrial consulting: technique, bills of materials, and process sheets, were the most commonly employed tools of our trade.

During that earlier time, most of us, if confronted with any among those fads of so-called “liberal economics” which have become “politically correct” opinion over the course of the recent three decades, would have retorted with words to the effect: “That’s insane; with your ‘funny-money’ theories, you will collapse the economy!” We would have been right, and prophetic, in making such a response. After three decades of a cultural paradigm-shift, which features “post-industrial utopianism,” the net physical output and input of the U.S. economy, as measured in physical market-baskets per capita of labor-force, has fallen to approximately half of what it was during the second half of the 1960’s.50

The corresponding, relevant difficulty, today, is that the topmost positions in government and in the most influential private institutions of business and education, are populated, predominantly, by “Baby Boomers,” the overwhelming majority among whom, have neither known, nor experienced a viable form of economic policy and practice during their adult lives. There are some exceptions, but they are relatively rare. Among today’s typical influential and other “Baby Boomers,” most of those radical policy changes of the 1970’s through 1990’s, including those policies which are responsible for the ongoing collapse of the physical productivity, income, and tax-revenue base of the U.S. population and its government, would be defended by most such “Baby Boomers” today as “mainstream thinking” of the post-1968 world. In German, the cant to this latter effect would tend to be seasoned with jargon such as Weltgeist, Zeitgeist, and Volksgeist.51

Consequently, the typical influential incumbent in government, university, or general economic practice today, will experience a great difficulty in overcoming his own, deeply engrained, misguided prejudices, when confronted with conceptions here which might have been understood with far more receptivity, and a higher level of competence in knowledge, by the same classes of influentials earlier, among the parents and grandparents of today’s “Baby Boomer” stratum.

Until the late 1940’s aftermath of World War II, most patriotic Americans (excepting the sometimes very odd Anglophile), understood, as did President Franklin Roosevelt, that the British monarchy, and British “free trade,” had been the consistent enemy of the United States throughout our history, and believed that the continuation of the British Empire was an abomination. We understood, whether we had studied Hamilton, Carey, and List, or not, that the (anti-“free trade”) American System of political-economy was the best model of economy ever devised: The war-time economic mobilization showed us that we were correct in that patriotic estimation.

During 1948-1952, returned veterans of the war-time skyrocketting of the U.S. economy, out of ex-President Calvin Coolidge’s 1930’s Depression,52 viewed the Truman administration’s reversing President Franklin Roosevelt’s intended post-war economic and foreign policies, as an embittering betrayal of our national heritage, of the policies which Treasury Secretary Alexander Hamilton named “The American System of political-economy.” The disgusting problem which I met among my generation, during the moral downturn from President Franklin Roosevelt, in policy-making of the late 1940’s and of the 1950’s, was their fear-ridden, “politically correct,” and, therefore, morally corrupt, capitulation to the unfortunate “way things were” under Truman and Eisenhower.

Such was the relevant collapse into cultural pessimism, which most of the parents of today’s “Baby Boomers” suffered, as a result of the moral decay spreading through my own post-war generation. Yet, among those professionals and skilled operatives of my generation who had the courage to think for themselves, many could have readily recognized the basis for, and competence of the line of argument on economics which I employed during the 1948-1952 project, and summon, yet once more, here.

The ignorant prejudices, respecting economy, which have come to predominate among influentials and others of today’s “Baby Boomer” generation, must be referenced in that historical setting. What must be said, to inform even relevant professionals among today’s “Baby Boomers” (in particular), goes against today’s perceived Zeitgeist, against that “mainstream” of opinion presently carrying our world civilization toward the cesspool. One may hope that these remarks have forewarned readers from the “Baby Boomer” generation, and others, against the misguided prejudices, which they will experience welling up within them, as we proceed.

From the outset, my work in the science of physical economy, was prejudiced by both my developed affinities for my adopted mentor, Leibniz, and the patriotic outlook on economy which I have summarized identified above. These were not merely prejudices; my 1948-1952 views on these matters, were significantly, if modestly well-informed, and, more important, stand up, in review, as predominantly correct, from my far more developed standpoint in knowledge and experience, today. Plainly, a generation of “Baby Boomers” which has, predominantly, accepted our nation’s recent and continuing drift, into the rubble-fields of “post-industrial utopia,” “information society,” “world government,” and “global economy,” will react with prejudice against much of what I have to report. Nonetheless, on the condition, that such readers will recognize that their reaction must be considered suspect, as reflecting an ahistorical faddism, a prejudice, as I have indicated here, they are perhaps half-way to understanding the important series of arguments which I supply now.

‘Not-Entropy’

The standpoint of the bill of materials and process sheet, provides us the basis in experience, for showing that the productivity of labor, as of productive enterprises generally, depends upon continuing to supply not less than some minimum level of essential inputs. During 1946-1966, when we were still a nation oriented to the production of wealth, it was the natural presumption of anyone with exposure to scientific training, that there must be some notion of function associated with the array of experimentally verifiable, physical facts gathered into such bills of materials and process sheets. From that latter vantage-point, the notion of function, we are impelled to recognize that it is insufficient to regard these essential inputs merely as “financial costs.” Their functional significance lies not in the prices attached to their purchase, but, rather, in the physical significance of these inputs, in determining whether the potential productive powers of labor rise, fall, or are simply maintained.

This applies to the level of income and public services supplied to the households of the labor-force; certain minimum standards of inputs must be met, if the productive potential, of both present and future members of the labor-force, is to be maintained in such a way as to maintain both net growth and the technological progress upon which that growth depends. This requirement applies to basic economic infrastructure (as supplied, traditionally, either as economic activity of government, or by government-regulated public utilities). It applies to agriculture and related production, mining, manufacturing, and other industry. It applies to the supply of education, of effective demographic performance of health-care, and of scientific and related services. It applies to consumption by households, by branches of useful economic activity, and to allowable and required amounts of administration of both governmental and private institutions.

Such considerations, bearing upon necessary physical standard of incomes of households, were the leading feature of Leibniz’s first writing on physical economy, his 1671 Society and Economy.53 The experimentally demonstrable relationship, between physical values of inputs and the predetermining of the potential (physical) productive powers of labor, pervades Leibniz’s economic and related writings on technology, throughout the 1671-1716 interval. The implications of this view, of a functional dependency of productive powers of labor, upon maintaining minimal cost-inputs, are otherwise attested by all of the known demographic history and pre-history of mankind. This viewpoint in the science of physical economy, obliges the investigator to premise the study of economic processes on no lesser scale, than the known demographic history, and pre-history of the existence of the human species considered as a functional oneness.54

Such a study begins, with a general overview of the upward sweep, and also occasional impairments, of population-size, population-density, and correlated improvements in the demographic characteristics of typical households. This must be done from the standpoint permeating Leibniz’s Society and Economy.55 From the historical period, we emphasize the dramatic improvements, on all counts, in not only the population of western Europe, but the world taken as a whole, since the first establishment of the modern form of sovereign nation-state, with the accession of France’s Council of Florence-linked, Renaissance figure, King Louis XI, during 1461-1483. Featured, included emphasis in that approach, is upon the reproductive power of society, per capita, per family household, per unit of land-area, and upon the improvement of demographic characteristics of those households (longevity, health, level of cultural development, etc.).56

Examining this matter more closely, we note that the inhering factor of “technological attrition,” relative to natural resources employed, prohibits a “zero-technological growth” model of society. We must examine the pre-historical and historical statistics of population and its demographic characteristics, from the standpoint of what we recognize, in modern civilization, as progress in science and technology.

These combined considerations lead us to a set of discoveries which, by definition, determine all the elementary features of not only a science of physical economy, but, also, any admissible theory of knowledge, knowledge of physical science included. It is that aspect of the inquiry which compels us to acknowledge the empirical evidence for the case of “time-reversal.”

The summary argument required for our purposes here, goes as follows.

To state the most characteristic feature of a physical economy in the terms of approximation afforded by textbook thermodynamics, agree to define the necessary physical costs (input) of an economy’s level of productivity (including administration), under the heading of “energy of the system,” and to consider the not-wasted, remaining portion of output, as “free energy.” “Energy of the system” includes both current new input, and the net replacement cost (in physical terms) of that portion of functionally significant physical capital, the which is stored within the economic process. The latter, stored, net (physical) capital investment, includes basic economic infrastructure, improvements in the physical-economic fertility of land, agriculture, industry, and a restricted portion of actively stored total services: in the form of education and health of the members of households, and science and technology potential of the labor force and enterprises.57

Express these, in first approximation, in my own changes in definitions for the symbology for the terms which Karl Marx adopted from his British teachers.58 Let V signify input/output of the labor-force, C signify required materials input for the entire economy (functionally defined), F net (functional) physical capital, d necessary deductions for government and administration otherwise, S output in excess of energy of the system, and S′ free energy (after deductions for both necessary administration and waste). Be reminded: read these symbols as defined here, not the Marxist reading. Prepare the way by describing the constraints to be examined, as follows.

The general constraints are:

- The potential population-density of the economy (as a whole) shall not be decreased, and the demographic characteristics of the population as a whole shall be improved.

- The inputs and outputs of the “market baskets,” and of their contents, shall be increased in absolute (physical) terms, for households, for performance of infrastructure, for agriculture and related, for industry, for education, for health care, and for science and technology services. These increases shall be measured in market-baskets, also as contents of market-baskets, and in terms of per-capita (of labor-force), households, per-square-kilometer of land area.

- The ratio of “free energy” to “energy of the system,” so defined, shall not decrease, but the relative energy of the system (per capita of labor-force, per household, and per square kilometer) shall be increased through reinvestment of “free energy” generated.

Population-density (adjusted for demographic parameters):

|(F) P1|≤ |(F)P2|.

“Free Energy” Ratio:

[S′1/(V1 + C1] ≤ [S′2 /(V2 + C2]

“Energy-Density” Ratio (per-capita of labor force):

[(V1 + C1] / F1]1 ≥ [(V2 + C2] / F2]2

But, the physical content of market-baskets (M) for productive functions, per capita, for labor-force:

(Mv)1 ≤ (Mv)2

and:

(Mc)1 ≤ (Mc)2

[NOTE TO TYPESETTER: END INDENT]

This set of “market-basket” relations overlays a set of constraints defined in terms of divisions in output of employment of the total labor-force’s operatives, letting V correspond to the operatives’ ration of the total labor-force.59 In this case:

[NOTE TO TYPESETTER: FOLLOWING IS INDENTED]

(V/C)1 ≥ (V/C)2

and

(S′/V)1 ≤ (S′/V)2

and

(S′/V + C)1 ≤ (S′/V + C)2

It should be noted, that the difference between the first, “market basket,” model, and the second, “division of labor,” model, is that the first states the relations of the second in terms of the per-capita relations between the society and the universe in which the society exists. The significance of the first, is that this representation is necessary for certain tasks, among which the most crucial is the consideration, that the relations between the physical-economic process and the process of generating scientific and technological progress, are located within those sovereign creative cognitive processes of the individual mind, wherein the generation and re-creation of valid discoveries of physical (and analogous) principle occur.60

Although this paradoxical set of expressions is set forth in descriptive terms used for modern nation-state economies, the implications so represented are necessarily characteristic of the human species’ entire span of historical and pre-historical existence. The paradoxical appearance of this set of constraints, does not bespeak some fallacy in our argument; the error is the critics’ own, the error of attempting to impose upon the universe at large, the purely fictional presumptions of the three so-called “laws” of thermodynamics, as the latter were prescribed by Lord Kelvin, Rudolf Clausius, Hermann Grassmann, H. Helmholtz, et al. The evidence refuting the latters’ widely taught thermodynamics dogma, is conclusive; it is now summarized as follows.

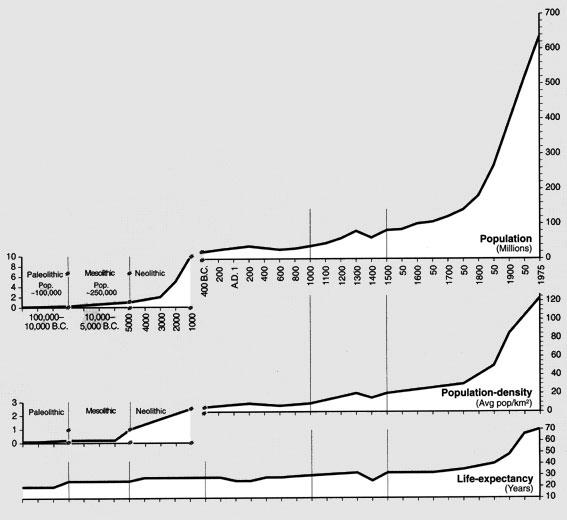

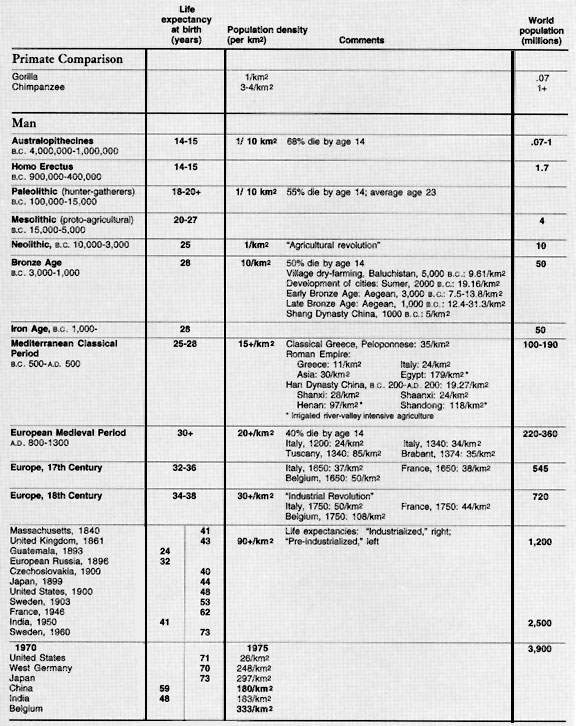

Probably, the student would not recognize the significance of many features of this process of human existence, if we focussed upon some pre-historical or early historical case, in isolation from modern societies; once the internal dynamic of modern civilization is understood, we recognize these same, underlying, hypothesizing of the higher hypotheses, the which underlie the modern, industrialized nation-state economy, already at work, in the assumptions which underlie the relative success or failure among even the earliest societies. The available data on changes in population, population-density, and demographic profiles of populations, from pre-history forward, to date, shows that the constraints we have just summarized here, are the characteristics of all successful efforts at continuing human existence [See Figure 4 and Table I].61

| FIGURE 4. Growth of European population-densityk, and life-expectancy at birth, estimated for 100,000 B.C.E—A.C.E. 1975.

Alone among all other species, man’s numerical increase is a function of increasing mastery over nature—increase of potential population-density—as reflected historically in the increase of actual population-density. In transforming his conditions of existence, man transforms himself. The transformation of the species itself is reflected in the increase of estimated life-expectancy over mankind’s historical span. Such changes are primarily located in, and have accelerated over, the last six-hundred years of man’s multi-thousand-year existence. Institutionalization of the conception of man as the living image of God the Creator during the Golden Renaissance, through the Renaissance creation of the sovereign nation-state, is the conceptual origin of the latter expansion of the potential which uniquely makes man what he is. |

|

|

Note breaks and changes in scales

All charts are based on standard estimates compiled by existing schools of demography. None claim any more precision than the indicative; however, the scaling flattens out what might otherwise be locally, or even temporally, significant variation, reducing all thereby to the set of changes which is significant, independant of the quality of estimates and scaling of the graphs. Sources: For population-density, Colin McEvedy and Richard Jones, Atlas of World Population History; for life-expectancy, various studies in hsitorical demography |

| TABLE I. Development of yhuman population, from recent research estimates. |

|

The known, combined, pre-history and history of mankind, presents us with the phenomena of a lattice of higher hypotheses: In other words, the phenomena subsumed by a functional notion which might be described only as the hypothesizing of higher hypotheses. That is to say, we have already extended the notion of “function,” to satisfy broader notions of “relationship,” notions of the higher types which Leibniz consigned to a generalized analysis situs. We have escaped the banality of a mathematics shackled by deductive formalism, into the primary relations which must necessarily underlie, and thus govern any competent mathematical physics, for example. We have moved the location for the primary relations within physical processes, away from the inferior domain of deductive propositions, to focus upon the determining relations, within the ruling domain of hypothesis.

The crucial paradox defined by the experimental evidence, which thus distinguishes successful from failed models of economy, is summed up: The ratio of net “free energy” to “energy of the system” must not be decreased, although the per-capita value of “energy of the system,” per capita of labor-force, per family household, and per relevant unit-area, must increase. To underscore the nature of this paradox, the following remarks are interpolated.

The source of the accumulation of physical capital, is the transfer from the account of “free energy” (symbolized by “S′ ” above), to “F.” The relevant experimental fact is, that should “S′ ” be distributed to increase of administration or personal consumption, above the “energy of the system” allowances for “V,” “C,” and “d,” the result would be a lowering of the rate of gain in the productive powers of labor, and, sooner or later, a net lowering of the per-capita standard of living of the labor-force. The trend in economic growth and incomes would be either merely less than if the amount is invested in “F,” or, worse, the factor of technological attrition would lead to negative growth, and, thus, to subsequent fall in standard of living of the labor-force.

However, in the alternative, that necessary consumption were postponed, in order to increase the stock of physical productive capital, as was done during the U.S. war-time recovery of 1940-1945, the results may be positive for the labor-force, and might have the effect of an economically successful “savings” program, which works to the advantage of the labor-force.62 Traditionally, prior to the 1966-1979 “cultural paradigm-shift” in U.S. economic policy, every competent farmer or industrial entrepreneur, and others, recognized this principle of saving: of capital-accumulation through postponed consumption, as leading to greater aggregated consumption than the alternative policy. The reconstruction of war-ravaged economies, provides compelling images of the same principle in practice.

To get at the true nature of the indicated paradox, one must define productivity in the indicated physical terms, stripping away all efforts to substitute prices for the physical variables which are the actual content of economic processes. There is no greater, or more popular form of lunacy among academic economists and their deluded admirers, than the effort to explain business cycles in terms of movements of prices. It was not private investment of money savings which created modern economies; it was the modern nation-state, which created the credit, and built the infrastructure, under which a society composed of citizens, rather than feudal subjects, organized the preconditions for the successful proliferation of private entrepreneurship.

Once the mind has cleansed itself of the effects of that mental disease called “financial statistical analysis,” the true nature of the paradox is forced to the surface. That paradox I have identified above, may be restated: The attempt to interpret economic processes, as if the presumptions underlying the “three laws of thermodynamics” were applicable, is effectively the act of a charlatan. What causes my constraints to appear to be self-contradictory to some would-be critics, is those critics’ attempt to explain economic processes without regard to that which sets human beings apart from baboons: those sovereign, creative cognitive potentials of the individual human mind, upon which the generation and successful application of fundamental scientific progress depend.

The apparent paradox is: The requirement that, under the conditions that net “free energy” is reinvested in the economy as a productive process, to increase the density of the process’ “energy of the system,” per capita of labor-force, and per relevant unit of land-area, the ratio of “free energy” to “energy of the system” must not decline. In summary, the process is characteristically “not entropic.”63

Thus, the associated, also crucial paradox, is, that experimental evidence also shows: This successful performance can not be secured, except through progress in what modern civilization has come to identify as an emphasis upon policies adopted as necessary to foster investment in “scientific and technological progress.” For the defenders of today’s generally accepted classroom mathematics, the implication of that requirement is more painful than any bare paradox; for them, it is a catastrophe.

These are paradoxes in the same sense as any experimental demonstration of the existence of a needed discovery of some new physical principle, a principle required to prevent existing mathematical physics’ descent into intellectual bankruptcy in face of an undeniable experimental challenge. In this case, the root of the difficulty is ultimately identical to the ontological paradox characteristic of Plato’s Parmenides dialogue. These are paradoxes derived from the pervasiveness of the cult of linearity in today’s generally accepted classroom mathematics, paradoxes of a type ultimately as fatal to the mental life of science as the paresis resulting from long infection with syphilis.

Underlying this blunder of the empiricists, of Leonhard Euler, of Immanuel Kant, et al., is a misconception of science, since Sarpi, Galileo, Fludd, Bacon, Descartes, Locke, Newton, et al., which has been concocted in search of congruence with that degraded, Venetian misconception of the nature of the human species, and human individual introduced as the Seventeenth and Eighteenth centuries’ French and British “Enlightenment.”64

45. The report of the relative competence of that adolescent’s defense of Leibniz, rests upon a 1970’s rereading of one of the notebooks on Leibniz and Kant, which I had filled with relevant comment, during the 1936-1938 interval.

46. E.g., “principle” is employed here in the sense of the act of discovery of a validated principle of physical science, or comparable principle of Classical art-forms. As above, such a principle is to be situated as Riemann does, as a “dimension” of a physical space-time manifold, and, hence, an axiomatic feature of some type of an hypothesis (hypothesis, higher hypothesis, hypothesizing the higher hypotheses), as distinct from a theorem-like proposition.

47. This would be understood as the Classical humanist approach to education, among that shrinking, already tiny minority, from among the victims of Twentieth-century trends in U.S. educational policy. The influence of the model of Britain’s Oxford and Cambridge Universities, which President Charles Eliot imported by fiat, to replace patriotism and the influence of C.F. Gauss and the Humboldt brothers (e.g., Louis Agassiz) at Harvard University, was accompanied and followed by the “decorticating” American Pragmatism of William James, the Rockefellers’ successful promotion of the Fabian John Dewey, and the more recent takeover of U.S. education generally by the influence of the “deconstructionist” current, such as the followers of Jacques Derrida, or the Modern Language Association (M.L.A.). The increasingly predominant uselessness of the generation of recent science graduates for serious scientific research into anything but the depths of “virtual reality,” is largely a reflection of the lack of even a remnant of Classical humanist principles in the elementary, secondary, and higher educational institutions today.

48. The interval, including the 1971 monetary crisis, from the introduction of neo-Malthusian doctrines into the State Department agenda, through the introduction of those “Volcker Measures” of October 1979, which accomplished the rapid destruction of the once great United States.

49. E.g., either the Earth is flat, or it is not: an example of a difference in theorem rooted in an underlying difference in principle. The uncompromisable issue, is primarily the principle; the fact that the theorem must not be compromised, is an “attribute” which the theorem “inherits” from the principle. Since British philosophical liberalism is premised upon a denial of knowable hypothesis, empiricism allows no notion of “uncompromisable principle” in the sense we employ it here. Our difference with the empiricists, on this point, is uncompromisable.

50. See Christopher White, “NAM’s ‘Renaissance’ of U.S. Industry: It Never Happened,” Executive Intelligence Review, April 14, 1995 (Vol. 22, No. 16). See also “U.S. Market Basket Is Half What It Was in the 1960’s,” Executive Intelligence Review, Sept. 27, 1996 (Vol. 23, No. 39).

51. This is not only a U.S.A. problem. In Germany for example, the 1989 assassination of Deutsche Bank’s Alfred Herrhausen, marked the end of the post-war era of successes in the German economy. Herrhausen was the last leading banker schooled in Hermann Abs’ school of principles of sound industrial banking; Herrhausen’s successors have turned out to resemble river-boat gamblers, more than bankers. It was during the 1980’s, throughout the world, that representatives of my generation were replaced, around the world, by the “Baby Boomers’ ” rise to controlling executive and academic positions in most of the world’s governmental and private institutions of policy-shaping power. The 1985 accession to Soviet General Secretary by Mikhail Gorbachov, symptomizes the same downshift to economic disaster in the last phase of the former Soviet Union. My generation, and its predecessors, were dominated by those capable professionals who specialized in promoting technological progress in physical development of infrastructure, agriculture, industry, and related qualities of educational, medical, and scientific services. The “Baby Boomer” generation is polluted with hedonistic fads in sociology, psychology, and monetarism. Since the approximately global “cultural paradigm-shift” of 1966-1972, the emphasis has shifted, from capital investment in increases of future physical-productive potential and demographic gains for the households of the population as a whole, into looting accumulated such investments from the past, to turn that loot into capital gains for “pirates” of the Carl Icahn, and Michael Milken types. So, as measured in income-ranges, the top 0.5% of the U.S.A. population grows fabulously richer, and ever more morally decadent, while the lower 60% accelerates its rate of downward slide into the depths of destitution. The 1982 Garn-St. Germain Bill, the Kemp-Roth Bill, the rise of the “Junk Bond” pirates, and the fanatical commitment of the GOPAC cannibals toward ever greater orgies of tax-free financial capital gains, even if this means increasing the mortality rates among their parents’ generation: It is the “mainstream opinion” which refuses to regard these recent trends as morally insane, which reveals that corruption of public opinion which is destroying us all.

52. The two most popular delusions respecting the causes of the 1930’s Depression, are the myth that President Herbert Hoover caused it, and, second, Professor Milton Friedman’s outright lie, that that Depression was caused by the Smoot-Hawley tariff legislation. Long before Smoot-Hawley’s enactment, and years before the election of President Hoover, the 1930’s was the foregone conclusion embedded in policies consolidated under Coolidge. Like the 1996 Republican Presidential candidate Robert Dole, encumbered with his Party’s commitment to the so-called “Contract with America” lunacy, Hoover entered the office of President in March 1929, encumbered by the legacy of Coolidge, to meet the outbreak of the fabled stock-market crash less than six months later. The 1930’s Depression was primarily a global phenomenon; the U.S.A., then the world’s chief financial creditor, was caught by the tidal waves of financial collapse inhering in the Reparations system set up by the Versailles powers. On the domestic side, it was the U.S.A.’s drift, away from a Hamiltonian tradition, into radical “free trade” policies, and speculative binges only less wild than those of today, which ruined the U.S.A.’s ability to meet the tidal waves of bankruptcy sweeping through the financial systems of our European debtor-nations. The Smoot-Hawley tariff was adopted in recognition of the fact that it had been “free trade” policies of Coolidge and Mellon, which had already plunged us into the Depression, which must be reversed, in favor of return to a traditional, patriotic, “protectionist” policy.

53. J. Chambless, trans., Fidelio, Vol. I, No. 3, Fall 1992.

54. Lyndon H. LaRouche, Jr., “Non-Newtonian Mathematics for Economists,” Executive Intelligence Review, Aug. 11, 1995 (Vol. 22, No. 32) (also Fidelio, Vol. IV, No. 4, Winter 1995). _______, “Leibniz From Riemann’s Standpoint,” Fidelio, op. cit.,: “Potential Relative Population-Density,” pp. 36-40.

55. Ibid.

56. Ibid.

57. Insofar as education of the household’s members, science and technology, Classical cultural activities, and health care, affect the productivity of the labor-force, and the demographic characteristics of typical households, these services, unlike virtually all other kinds of services, determine the rate of growth of mankind’s per capita reproductive power over nature, the power of our species over nature. The growth of man’s potential power over nature, per-capita of labor-force, per household, and per relevant area, is the measure of the validity of discovered principles underlying society’s practice, on the condition that the requirement for a demographic improvement is also satisfied.

58. During the span of his university studies, first at Bonn and later at Savigny’s Berlin, Karl Marx was recruited to the British foreign service’s “Young Europe” organization. He continued under the sponsorship of Lord Palmerston’s Giuseppe Mazzini, from that point, until the death of Palmerston, and perhaps slightly beyond; for much of that period, Marx was operating in London under the supervision of Palmerston’s subordinate and rival David Urquhart. It was under Urquhart’s guidance, that Marx elaborated his so-called “early writings” on economy, during the 1850’s, and laid the basis for his Das Kapital. François Quesnay, Giammaria Ortes, Adam Smith, and the British East India Company’s Haileybury school (as developed under the patron of Lord Palmerston’s career, the British foreign service’s Jeremy Bentham), are the principal sources from which the analytical features of Das Kapital are derived. It is Marx’s venom against such American System economists as Friedrich List, and later condemnation of Henry C. Carey, both motivated, according to Marx himself, by F. Engels, which, as the proverb goes, “give the game away.”

59. See, Lyndon H. LaRouche, Jr., So, You Wish To Learn All About Economics? (1984), 2nd ed. (Washington, D.C.: EIR News Service, Inc., 1995), passim.

60. As opposed to the social model of Thomas Hobbes, John Locke, Bernard de Mandeville, David Hume, François Quesnay’s laissez-faire, Adam Smith, Jeremy Bentham, John Stuart Mill, et al. In the Hobbes model, the individuals of society are treated as kinematically interacting particles, of fixed, linear, axiomatic properties, interacting within the virtual reality of a mechanistic “gas theory.” In reality, the determining relations are located with respect to the development of the sovereign creative cognitive processes internal to the individual’s mind.

61. Relevant studies of so-called “primitive” societies, dispel the illusion that these are predominantly aboriginal, or approximately aboriginal forms; as in cases such as anthropological studies of the language and behavior of the so-called “digger Indians,” in the usual case, virtually all cultures which some commentators prefer to identify as relatively “primitive,” are in fact degenerate relics of the collapse of an earlier, relatively higher level of culture: either an externally imposed catastrophe, as in the instance of the so-called “digger Indians,” or a self-imposed catastrophe, as in the case of the repeatedly failed cultures of ancient Mesopotamia.

62. The appearance, that the presenting of the war-time savings by the labor-force as demands upon the post-war economy, caused the inflation of 1946-1947, is a fraudulent reading of the evidence, a non sequitur, a fallacy of composition. It was the Truman policy of 1945-1948 which caused the menacing inflationary spiral of that period (a policy which the Truman administration adopted at the behest of the Anglo-American establishment generally, and the Federal Reserve influentials in particular). To create the economic mobilization for war, a large mass of withheld wages and other income was channelled, through war-time austerity measures, into capital formation in agricultural and industrial potential, in addition to expenditure for military goods. To deal with the post-war effects of this postponement of personal income, it was imperative that, with the close of war, no significant industrial demobilization must be allowed. We should have converted the build-up of the tool-industry for war, to civilian capital-goods production; under no circumstances, should a general collapse of the level of industrial output be forced, as it was, or even allowed. The critical problem was the failure to deploy a “dirigist” program for rolling over war-time industrial build-up, rapidly, into high rates of agro-industrial build-up for civilian capital-goods output, a failure which collapsed the physical growth-rates of the U.S. economy, as the postponed monetary expenditure began to flood into the markets. Similarly, since 1971, a world-wide inflation has been sustained, not by an excess of money, but by a growing insufficiency of investment in technology-intensive, capital-intensive, and energy-intensive modes of both agro-industrial production of goods, and build-up of the capital stock of high-technology infrastructural investments. Where lunatic monetarists see an “excess of money,” sane economists see a shortage of investment in technologically progressive output of goods.

63. The obligation to say “not entropic,” rather than “negative entropy,” has been imposed by the “information theory” cult’s misuse of the term “negentropy,” to signify a mechanistic implication of Ludwig Boltzmann’s H-theorem.

64. Among the numerous published locations in which this writer has addressed the matter at some length, relevant recent instances include the following; “Non-Newtonian Mathematics for Economists,” loc. cit.; “How Hobbes’ Mathematics Misshaped Modern History,” Fidelio, Vol. V, No. 1, Spring 1966; and, “Leibniz From Riemann’s Standpoint,” loc. cit.

![]()

schiller@schillerinstitute.org

The Schiller Institute

PO BOX 20244

Washington, DC 20041-0244

703-297-8368

Thank you for supporting the Schiller Institute. Your membership and contributions enable us to publish FIDELIO Magazine, and to sponsor concerts, conferences, and other activities which represent critical interventions into the policy making and cultural life of the nation and the world.

Contributions and memberships are not tax-deductible.

VISIT THESE OTHER PAGES:

Home | Search | About | Fidelio | Economy | Strategy | The LaRouche Frameup | Conferences

Links | LaRouche | Music | Join | Books | Concerts | Highlights | Education |

Health | Spanish Pages | Poetry | Dialogue of Cultures

Maps | What's New

© Copyright Schiller Institute, Inc. 2006. All Rights Reserved.